Articles

Payment Gateways for International eCommerce: Finding the Right Fit

4.09.2023

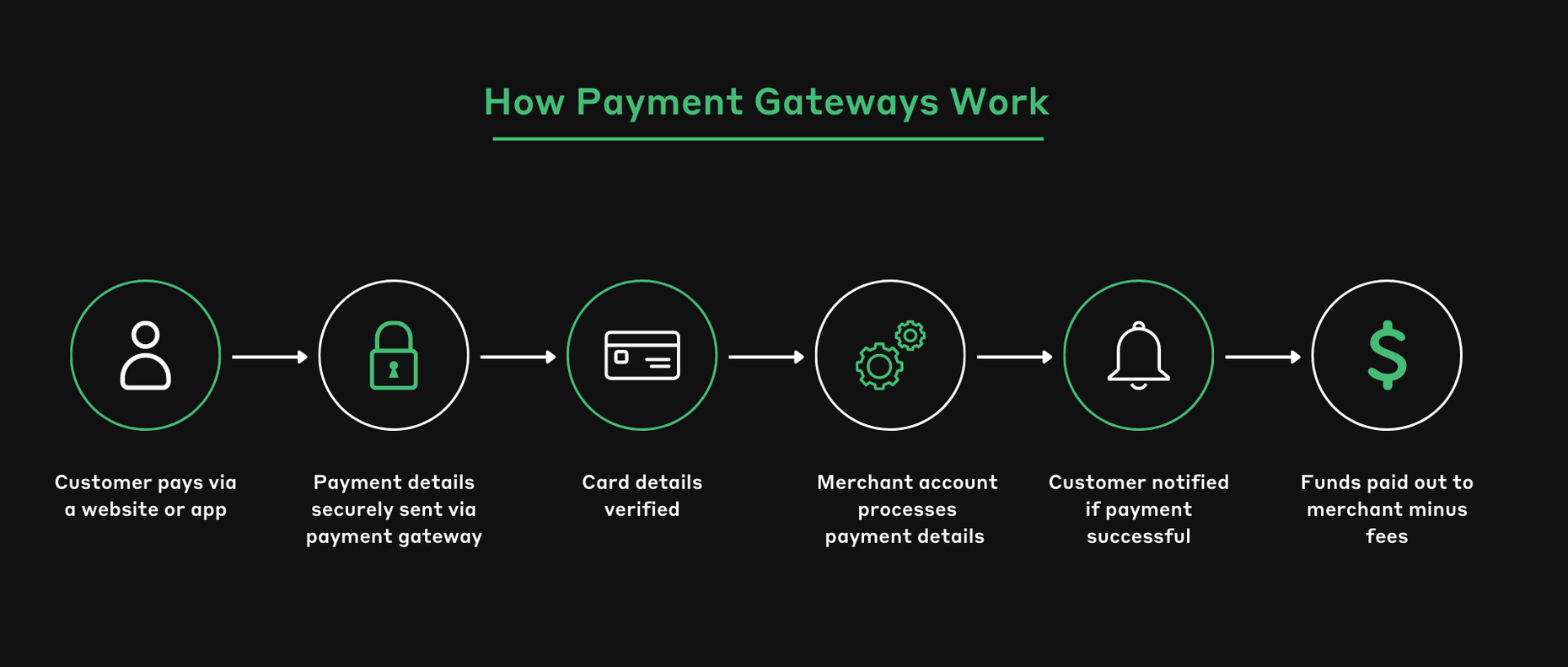

Payment gateways enable websites to accept debit or credit card purchases, serving as a link between customers, businesses and payment processors. They simplify payments for businesses, and are able to handle multiple currencies and adapt to different local payment methods.

But are all payment gateways created equal? What are the factors you should consider when choosing a provider? And does your business stage and the location of your customers make some more appealing than others?

Here’s a quick guide on how to assess payment gateways and pick one that’s tailored to your business’ needs.

The Service and the Charge

A payment gateway is software that ensures both the seller and customer’s best interests. While customers are assured of payment security (which helps sellers too by putting customers’ minds at ease), sellers can outsource a necessary yet arduous task, which is particularly attractive to SMEs as they are unlikely to have enough staff to cope with every business facet internally.

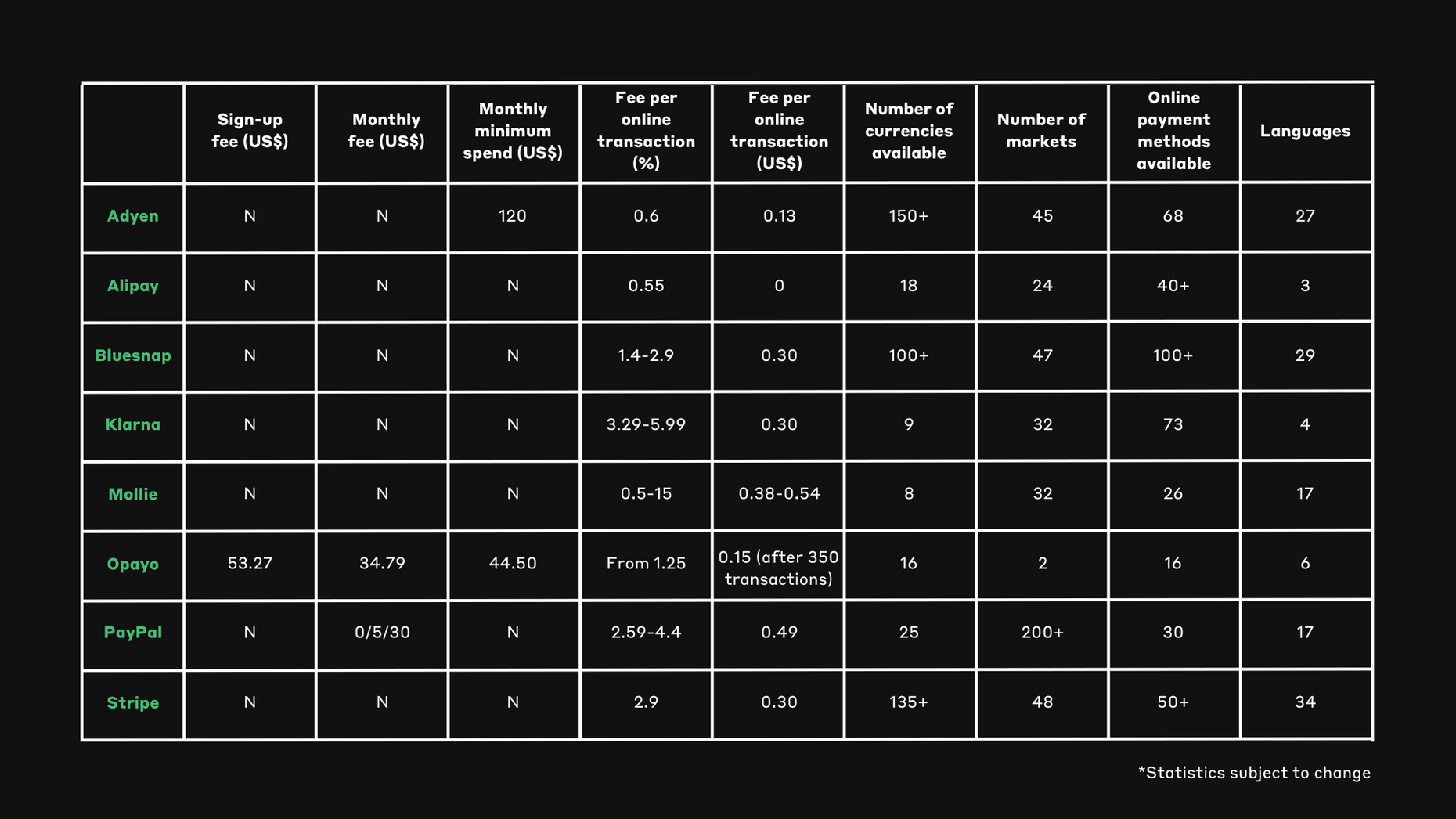

As service providers, payment gateways will charge eSellers a fee. This can include sign-up, subscription, percentage and per-transaction, so the volume of deals and money expected via this means should influence your decision. They charge for currency exchange (such as the 2% Stripe charge and the 3% for currency conversion plus 1.5% for international transactions PayPal charge), so under these circumstances, you’re better off pairing these services with a multi-currency digital wallet.

The size of your firm, markup of your items and consistency of your business will also determine the suitability of certain options, as you may struggle to afford the fee some demand if your profit margins are already thin. You should also factor in the payment gateway’s market penetration in the jurisdictions you target, as well as whether they support payment methods that are popular within them.

Who Stands Out and Why?

TSG’s rationale for awarding certain payment gateways sheds light on aspects you should consider, as do ratings on sites such as G2.com.

TSG takes into account two assessment criteria: documentation and functionality (usability), and roadblocks to integration and development (convenience). They note that Application Programming Interfaces (APIs) “offering support for multiple programming languages tend to attract more developers who can leverage the API documentation effectively”, as well as “ensuring that…API documentation is readily available in a convenient, centralised online location is crucial”. This means they feel access to intuitive logs should be a high priority. Their winners include Adyen, CSG Forte and North American Bancard.

G2.com provide information on users, industries and market segment, as well as ranking what they see as the top 20 payment gateways on how easy they are to use. Payment gateways are also given a rating out of five based on users’ thoughts on aspects such as performance, reliability and eCommerce integration. While Paytm Money received top ranking for easiness, numerous alternatives such as NMI (second in easiness) received a higher score overall, highlighting that no one size fits all.

Payment Gateways’ Different Sizes

Online research sheds light on what certain payment gateways champion, as well as the aspects that have both aided and frustrated users. Here’s a sample of what’s on the market, but if none fit you, don’t fret – one estimate claims that there are over 900 payment gateways worldwide.

Adyen don’t charge setup, monthly or early-termination fees. Their services are, however, more suitable for larger businesses as there’s a required monthly minimum spend (though this is only US$120), so you may suffer if you run a small business or have slow periods.

Alipay services are well-known in Asia, and they have built a lot of customer loyalty. While well known in the Eastern hemisphere though,they are less known and less trusted in the West, so if you want to sell globally, exclusively offering Alipay will massively hinder sales.

Bluesnap have 100+ global payment types as well as offering 100+ shopper currencies, widening your potential customer base. They also, however, have some of the worst user reviews, with customers complaining about sudden cancelation of accounts, slow transfer of funds and poor customer service.

Klarna lets users pay over time in instalments, so appeals to customers who require flexibility. They also try to drive customers from their own channels to partner businesses. They don’t charge joining or monthly fees, but do charge high per-transaction fees, making them suitable for businesses with slow periods, but unsuitable for those with lower profit margins. Reviews are mostly positive, but their weaknesses include identity verification, responsiveness and crisis management. Buy now, pay later services also have a higher risk of fraud.

Mollie, according to reviews, have great customer service and accounts are easily set up. They focus on businesses in Europe, so may be unsuitable if you are based elsewhere, but do enable payments with vendors that are accepted worldwide. Their fees range from 0.5% plus €0.50 to 4.99% plus €0.35 and even a flat rate of 15%. So while reviews tend to be positive, their fees can be substantially higher than those of competitors. This all means that you should consider the type of payments you expect before signing up.

Opayo offer two types of online payment gateway plans, so that you can pick whether a monthly fee with lower transaction fee and no joining fee makes more sense for you than no monthly fee but a higher transaction fee, gateway click-fee and one-off joining fee. Their market is limited, as they only serve the UK and Ireland. Reviewers are happy with the ease of navigation, but do note a lack of tools and clarity for users.

PayPal, as with Alipay, enjoys market trust. They also offer a range of price plans, good developer tools and an all-in-one system. However, they have been known to suffer account stability issues, have inconsistent customer support and be unsuitable for high-risk industries, with their per-transaction fee hurting small-ticket merchants.

Stripe reviews laud their pricing as well as championing their tools and payment methods, but caution about their account stability and user-friendliness. Direct comparisons with the aforementioned PayPal prove favourable if you have a large company, as they enable more options for payment customisation, but unfavourable if you run a small or new business, as Paypal has simpler setup and is less technically challenging.

Which Size Fits You?

Currenxie is compatible with all the aforementioned gateways, so if currency exchange is high on your agenda, choosing from them will be beneficial as we can support your exchange needs. Most do offer currency exchange services, but at much higher rates than ours.

To see who’s going to support your business needs, you should also check whether their current clientele tends to be at your business stage and operate in your preferred markets, as this will dictate their orientation. This can be discovered by checking who’s reviewed them on sites such as Trustpilot and the clients listed on their websites.

You should also be aware that though the cause of a customer’s frustration may be with a payment gateway, they may associate poor experiences such as poor customer service with your business. For the best demonstration of how they deal with customers, why not try ordering something from a site using that payment gateway then returning it?

Can You Create Your Own?

The short answer is yes, but unless you run a fintech company, you shouldn’t even consider this option.

The upside of creating your own is that it can generate revenue by saving you fees, and – if the custom features you create appeal to others – be sold to other businesses for their use, as well as giving you more control over processing.

However, using your own gateway may cost you customers if people don’t trust the unfamiliar, as well as being costly to set up, requiring maintenance and resulting in security issues being your responsibility. So even if you specialise in fintech, employee time and energy will probably be better utilised on your core business, especially if you run a young or small business.

Your Bottom Line

Businesses that are just starting out would be wise to avoid the risk of creating their own payment gateway and using gateways that require a minimum spend. But if you’re already consistently reaping the benefits of international sales, the latter shouldn’t be an issue.

It’s worth getting in touch with any gateways you’re considering early on, as if you have your heart set one one after hours of research only to find out it can’t easily be integrated with the software and tools your site uses, you may be sent back to square one.

While being charged no monthly or sign-up fee sounds great, it’s important to note that the payment gateways with this pricing will probably charge higher per-transaction fees. This charge can eat too much into your revenue if your profit margins are already thin, and make these options unsuitable.

Don’t forget that different people trust different gateways, so while international gateways may seem logical if selling in numerous markets, countries’ residents may be more familiar with and trusting of local providers; so while offering several payment gateways will require more time to set up, this may be what makes you stand out from your competition.

Selling online and at scale is crucial for eCommerce survival in the modern world. While shoppers are returning to brick-and-mortar outlets after COVID-19, the convenience of easily comparing deals from the comfort of your own home means online shopping is going nowhere, with Statista forecasting a 56% growth in spend from 2021 to 2026, when a massive USD 8.1 trillion will be spent.

To have the best chance of getting a large piece of that pie and keeping your revenue, pick a payment gateway that’s trusted, easy to use and won’t take too much from your profits.

And if you’ll be selling across borders and currencies, pair your chosen gateways with a multi-currency digital wallet, as these tend to have lower fees than those of payment gateways that offer this service.

Sign up for our multi-currency account to start receiving money from your chosen payment gateways here.